First published on Sunday, July 26 in The Colorado Sun:

Working for one of Colorado’s oldest family foundations, we heard panic from our community lending partners almost immediately as the COVID-19 pandemic began forcing closures: The smallest local businesses — the ones without bankers on speed dial, many nonprofits, and those owned by minorities, women, veterans, immigrants — were falling through the cracks.

These businesses are the fabric of their communities, the cornerstones of Main Street. Yet as the first round of $349 billion in federal Paycheck Protection Program (PPP) loans ran dry in just two weeks, we were meeting with state officials and fellow funders to sound the alarm that these businesses were being overlooked, and exploring how we might develop and support Colorado solutions that would specifically address their needs.

The Energize Colorado Gap Fund is one result — starting in early August, Colorado’s sole proprietors, businesses, and nonprofits with fewer than 25 full-time employees can apply for grants of up to $15,000 and loans of up to $20,000, for a combined maximum of $35,000 in financial assistance. Priority will be given to rural businesses and those owned by women, veterans and/or BIPOC (Black, Indigenous, and People of Color). The Fund is designed to keep low-cost capital flowing in communities across Colorado as federal stimulus programs like the PPP wind down.

Another silver lining for small businesses: While August 8 deadline for PPP applications is fast approaching and many traditional banks have stopped accepting applications, Colorado’s three SBA-approved nonprofit lenders – DreamSpring, Colorado Enterprise Fund, and Colorado Lending Source – still have money in the bank and stand ready with Zoom windows open to serve the state’s smallest and most vulnerable businesses, and help position them to recover and rebuild in the new COVID-19 environment.

The PPP process is easy, and these three trusted nonprofit lenders have a successful track record of working with underserved business owners across the state. They provide not only affordable loans and other financial services, but also the training and technical resources to ensure successful repayment and long-term sustainability.

Since April, these three nonprofit lenders have made PPP loans to 1,593 small local businesses, totaling more than $45 million and protecting the jobs of more than 6,850 Coloradans. More than half of these businesses are minority-, women-, or veteran-owned, and the average size of the loans is less than $30,000. The loans are completely forgivable, so long as certain parameters such as employee retention are met.

Early Success Academy, an early learning center in Denver’s Montbello neighborhood, is just one example of how previously overlooked businesses are now gaining access to the PPP program. Owner Diana Gadison came to the Colorado Enterprise Fund for help, after her first PPP application submitted through a mainstream bank was denied. In 1995 CEF provided Gadison with her first $10,000 loan to open her business — and came through this time as well. “Because of their swift action and personally helping us navigate through the complex government requirements, we now have the funds to re-open in 30 days with all nine employees still on board,” Gadison told us. “The rent will be paid, and health insurance is intact with no interruption in benefits. This is critical for my employees, including myself, who are being treated for or are recovering from various health conditions.”

Gadison’s story is not uncommon across Colorado. Kelly Watters, a co-founder of Western Rise, an apparel manufacturer based in Telluride, was turned away from seven different lenders before securing a PPP loan through Colorado Lending Source. A PPP loan from DreamSpring helped Lisa and David Jacobson of Gunnison not only keep 20 employees on the payroll at their 16-year-old family restaurant, The Gunnisack, but also pay them about 25 percent extra during closure. In a town with just 6,500 residents, that makes a difference.

For those of us who are frustrated by the institutional inequities that plague our state’s BIPOC communities and underserved business owners, it is gratifying that Colorado’s nonprofit lenders were able to participate in the second round of PPP loans. Behind the scenes, this took some wrangling — including direct commitments of capital and a creative bit of financing supported by multiple local foundations, the State of Colorado and FirstBank Colorado.

With a turnaround time of less than a week, Gates Family Foundation worked with the State’s Office of Economic Development and International Trade, Gary Community Investments, and AJL Foundation to use the strength of their balance sheets and FirstBank’s capital to ensure that federal stimulus dollars reached the smallest and least banked businesses across the state. In addition, other funders — including Zoma, The Colorado Health Foundation, and Bohemian Foundation — advanced capital independently toward the same end.

It shouldn’t be this hard. If women, people of color, and veteran-owned businesses had equitable access to capital across the board, creative interventions like these wouldn’t be needed. But what we learned was also important: When we work together with a shared mission to better serve our state’s overlooked but strong small business owners, we can help make sure support gets to the right places.

We salute Colorado’s nonprofit lenders for their overwhelming responsiveness, and encourage Colorado’s small business owners to contact them to take advantage of the federal PPP program by August 8 — and to apply for grants and support through the Energize Colorado Gap Fund in early August.

Sue Dorsey is Senior Vice President of Finance, Administration, and Impact Investing for the Denver-based Gates Family Foundation, and serves on the Executive Committee of Energize Colorado.

Finally, also in 2023 a total of $410,956 previously committed by Gates to the

Finally, also in 2023 a total of $410,956 previously committed by Gates to the

A total of $1,110,956 committed to the

A total of $1,110,956 committed to the  In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to

In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to  Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies:

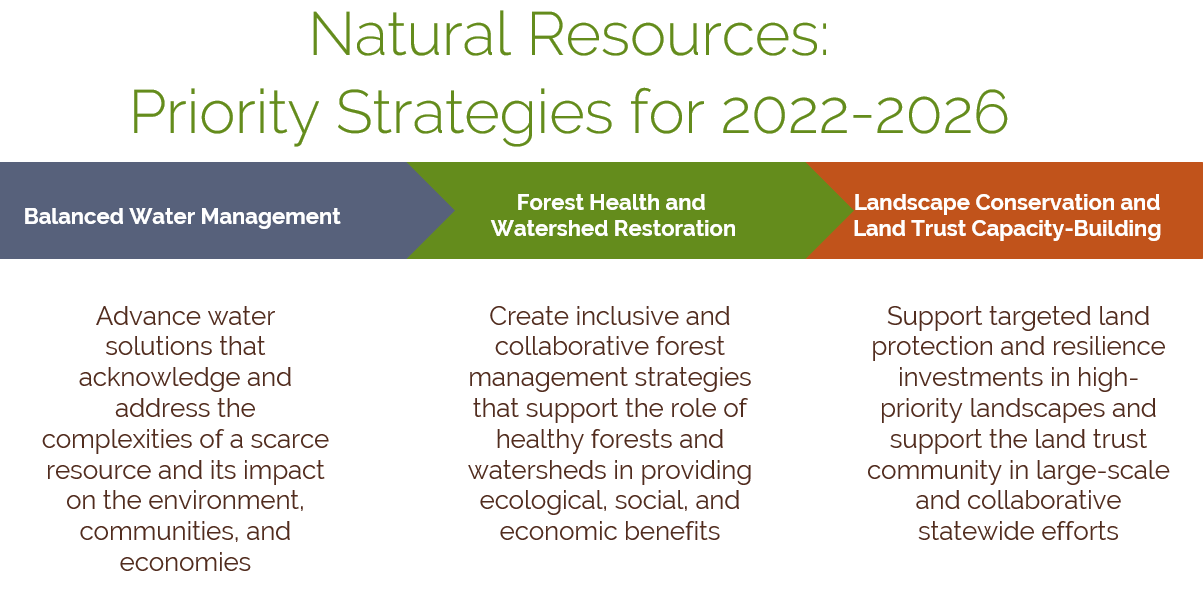

Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies: