As Colorado’s small businesses — both owners and employees — face unprecedented challenges due to the COVID-19 pandemic, Gates Family Foundation has focused its attention on how to ensure that the most vulnerable small businesses, many of which were left out of the federal government’s initial stimulus programs, can endure the crisis and be a part of the economic recovery in their communities.

By using a broad range of philanthropic support — including grants, debt, deposits, guarantees and collaborations — Gates has been able to deploy and activate far more capital than grants alone would allow. Importantly, we also have targeted our support toward Colorado’s smaller, more informal businesses — especially those covering a range of underserved populations, including rural geographies, minorities, women, and native communities.

In late April, just before the release of $310 billion in second-round federal Paycheck Protection Program (PPP) loans, the Gates board approved the foundation’s second major COVID-19 Rapid Response package — devoting $300,000 in grants and nearly $2 million in recoverable program-related investments (PRIs) to help ensure that trusted nonprofit lenders themselves continue to have the capacity and ability to move capital out the door quickly and diligently. A list of these capacity-building commitments is below, including one additional $50,000 grant to the Main Street Phoenix Project approved in May.

In addition, Gates Family Foundation used its balance sheet to support a $12.5 million loan at 1% from FirstBank to three SBA-approved nonprofit lenders in Colorado (DreamSpring, Colorado Lending Source, and Colorado Enterprise Fund). This liquidity enabled these nonprofit lenders to make PPP loans to thousands of small businesses across Colorado, including many minority-, women-, and veteran-owned small businesses that did not have a relationship with a formal bank and thus had been cut out of the first round of PPP funding.

The Gates loan was guaranteed through a collaboration with Gary Community Investments, the State of Colorado’s Office of Economic Development and International Trade (OEDIT), and AJL Foundation. This partnership was a unique way for Gates, the State, and other foundations to use the strength of their balance sheets and FirstBank’s capital to ensure that federal stimulus dollars reached the smallest and least banked businesses across the state. A number of other funders — including Zoma, Colorado Health Foundation, and Bohemian Foundation — also moved independently to help meet the all of needs of Colorado’s nonprofit lenders and small businesses.

The need to move swiftly on the PPP opportunity with FirstBank and Colorado’s three SBA-approved nonprofit lenders was urgent. As the next element of federal relief was being negotiated in Washington, many called for rules to ensure that smaller, community banks and nonprofit lenders, particularly those that service minority and underbanked populations, have a leg up in the lending process.

Within the $310 billion second-round PPP loan program, $30 billion was allocated specifically for SBA-approved nonprofit lenders. Nonprofit lenders are generally not able to accept deposits, so they were in urgent need for capital in order to book PPP loans and capture Colorado’s share of the $30 billion allocation. As expected, all of the money for smaller, nonprofit lenders was committed in a matter of days — though lenders with liquidity can still compete for PPP loans in the broader program.

Separate from Gates’ support of the $12.5 million FirstBank loan, Gates’ direct grants and PRI support for Colorado’s trusted nonprofit lenders has helped to ensure that they had the organizational capacity to be ready and able to process PPP loans, and also begin preparing for what comes next after federal stimulus support runs out in three to six months.

The following nonprofit lenders and community-based organizations also provide capacity building and education to help small businesses access local and federal relief funds. Micro-grants can go a long way for many of Colorado’s smallest businesses, and good lenders are trying to weed out those businesses that may not make it from those that have the best chance. Support for this kind of activity is where limited resources can make a big impact. On PRIs, we have also committed to keeping Gates’ interest rate low or 0%, so that lenders can on lend to small businesses at very low and very flexible terms.

With these criteria as our guide, we are pleased to announce our COVID-19 Rapid Response — Small Business Supports:

| Organization | Purpose of Support | Population Served | Region | Grant Capital | Program-Related Investment (PRI) Capital |

| DreamSpring | To launch a Relief & Recovery Fund that supports interest-only or deferred payments for existing loans, new business recovery loans, and support services to help navigate the COVID crisis and recovery | 70% women, minorities, and low income | Front Range

|

$50,000 | |

| Rocky Mountain Microfinance Institute | To support the Entrepreneur Responsiveness Package, which provides stabilizing microgrants, a three-month loan payment holiday, and a “pivot accelerator” grant and capacity building initiative to help entrepreneurs who have a solid idea to pivot or re-engineer their businesses for relevance post-COVID-19 | 60% women 40% Black 100% < 80% AMI* |

Denver Metro | $50,000 | |

| Sistahbiz | To support black female entrepreneurs as they navigate the economic fallout and recovery of COVID-19 | Black women | Denver Metro | $25,000 | |

| First Southwest Community Fund | A grant to support the technical assistance program, loan loss reserves, and administration of the Rapid Response and Recovery Loan Fund, and a PRI to support the capitalization of the fund | Rural communities under 50,000 |

Rural Colorado | $50,000 | $500,000 (debt at 0%) |

| Colorado Lending Source | A grant for the organization’s administration costs to run the Emergency Colorado Main Street Loan program, and a PRI to support the capitalization of the program | 72% start ups 35% rural 40% women SBA lender |

Statewide | $25,000 | $250,000 (debt at 0%) |

| Native American Bank | To support the first, recently-opened Colorado branch, which provides NAB greater access to a large Native American community in Denver and across Colorado | Native Americans | Native Communities | $240,000 (Certificate of Deposit) |

|

| Energize Colorado Gap Fund | To support a public-private “fund of funds” that supports small businesses and nonprofits that are ineligible or otherwise not served by existing or future SBA loan programs | <25 employees | Statewide | $100,000 | $1,000,000 |

| FirstBank PPP Credit Facility | To support a loan from FirstBank to Colorado’s three SBA-approved nonprofit lenders, allowing them to make PPP loans to thousands of small businesses across Colorado, including many minority-, women-, and veteran-owned small businesses | PPP criteria | Statewide | $12,500,000 debt at 1% ($5,000,000 guaranteed by Gates, remainder by GCI, OEDIT and AJL) | |

| Main Street Phoenix Project ** | To support for employee ownership conversion opportunities | Statewide | $50,000 | ||

| Total | $350,000 | $14,490,000 |

* AMI – Area Median Income (AMI) one of the main metrics for affordable housing. Households living at or below 80% AMI are considered “low-income”

** Approved by Gates board in May and subsequently added to this list of COVID-related small business investments, bringing the total to $14,840,000 committed and leveraged to support Colorado small businesses survive and thrive amidst the COVID crisis.

Finally, also in 2023 a total of $410,956 previously committed by Gates to the

Finally, also in 2023 a total of $410,956 previously committed by Gates to the  A total of $1,110,956 committed to the

A total of $1,110,956 committed to the

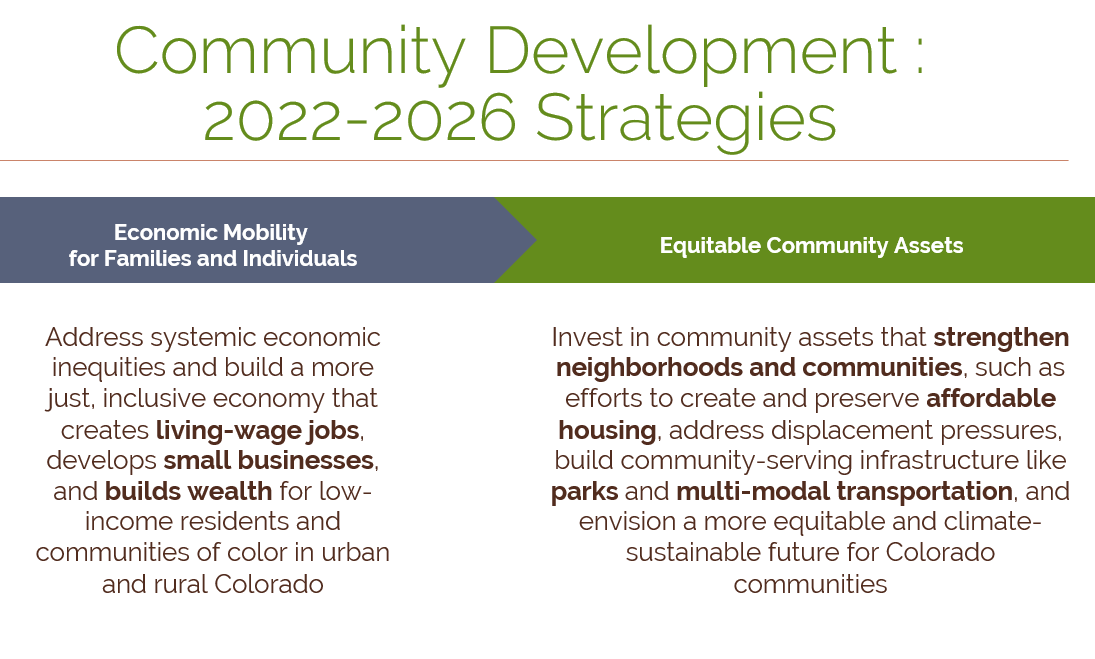

In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to

In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to  Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies:

Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies: