Grant

Lyme Timber Company LP – Opportunities Fund

$1,000,000 | Awarded: 2019

An investment in a private equity fund focused on the acquisition and sustainable management of timberlands with unique conservation values throughout the U.S. Previous…

Mission-related investments (MRIs) commit a portion of the Foundation’s endowment capital for mission-aligned purposes that meet a market-rate return expectation.

Grant

$1,000,000 | Awarded: 2019

An investment in a private equity fund focused on the acquisition and sustainable management of timberlands with unique conservation values throughout the U.S. Previous…

Grant

$3,000,000 | Awarded: 2019

An investment in an institutional fund focused on generating strong, risk-adjusted returns through: creating and preserving affordable multifamily housing; implementing practical green strategies to…

Grant

$1,000,000 | Awarded: 2019

An investment in a strategic healthcare fund affiliated with the University of Colorado Anschutz Medical Campus that invests in ventures across the healthcare spectrum…

Grant

$1,500,000 | Awarded: 2019

An investment in a private equity fund that provides growth capital to Colorado companies that have potential to generate strong market returns, but also…

Grant

$3,000,000 | Awarded: 2019

An investment in an industrial impact fund focused on resource efficiencies in energy, transportation, and the built environment.

Grant

$3,000,000 | Awarded: 2019

An investment in a private equity fund focused on affordable housing and transformative development projects across the U.S.

Grant

$3,000,000 | Awarded: 2018

An investment in a private equity fund focused on early-stage tech tools, applications, content, and services to improve educational opportunities for all children.

Grant

$2,000,000 | Awarded: 2018

An investment in a private equity fund focused on the acquisition and sustainable management of timberlands with unique conservation values throughout the U.S.

Grant

$1,000,000 | Awarded: 2018

An investment in a private equity fund that supports the conservation and restoration of ranch properties in Colorado and nearby states.

Grant

$3,600,000 | Awarded: 2015

An investment in a private equity fund that provides growth capital to Colorado companies that have potential to generate strong market returns, but also…

Search insights, news, and feature stories from the Gates Family Foundation and our partners.

Whitney Johnson, Senior Program Officer

Whitney Johnson, Senior Program OfficerWith impacts to Colorado’s rivers and working and natural lands continuing to mount in the face of climate change, we are acutely aware of both the sense of urgency and the scale that we have to operate. Colorado State University recently released its third edition report on climate change in Colorado, which confirms what we see on our lands and in our rivers; our climate has become much warmer and further warming is expected. These warming trends are impacting Colorado’s snowpack, stream flows, soil moisture, natural and working lands, and the places we live, recreate, and protect.

Supporting Coloradans who are most impacted by climate change and least involved in decision-making drove our Natural Resources team to look for opportunities and build new relationships. Woven throughout each of the following Natural Resources focus areas, our investments centered equity and leadership development, policy support, and capacity:

The Natural Resources team used every tool in the Foundation’s toolbox to support our partners across these three priority areas. To help catalyze new ideas and sustain promising efforts, we leveraged both initiated and capital grant dollars, program-related investment dollars, the power of convening, and a commitment to long-term funding through our Focus Landscapes initiative.

In 2023, the Natural Resources program awarded:

— $30,0000 in a responsive capital grant to Eagle Valley Land Trust for its conservation center

— A $250,000 program-related investment (PRI) commitment to the National Forest Foundation for its wetland mitigation efforts

— A total of $1,335,000 to support land conservation and stewardship in Southeast Colorado and the San Luis Valley, as part of our Focus Landscapes initiative

— A total of $700,000 over two years to further Gates leadership in advancing the mass timber industry

— An additional total of $533,000 in strategic grants to 13 organizations, some which are highlighted below

Climate change continues to severely impact Colorado’s water systems, and researchers predict that rivers may shrink by as much as 30 percent by 2050. In 2023, Gates Family Foundation supported the Lincoln Institute’s Water & Tribes Initiative, which was established in 2017 to serve as connective tissue for Tribal Nations to increase their own capacity and collaboration in developing water resource and policy decisions for the Colorado River Basin. The Sangre de Cristo Acequia Association represents 73 acequias in the San Luis Valley; these community-operated water management systems are a longstanding model of water sharing for over 300 families throughout the Valley.

Forest health and watershed health are closely linked, with a majority of Colorado’s water supply coming from forested watersheds. Due to drought, wildfires, overly-dense stands, and disease Colorado’s forests actually emit more carbon than is stored. In 2023, Gates Family Foundation continued our collaborative funding approach with the National Fish and Wildlife Foundation, Great Outdoors Colorado, and other state, federal, and private partners to support the RESTORE Colorado Program. This initiative advances land restoration efforts on river corridors, riparian areas, wetlands and forestland, and prioritizes cross-jurisdictional projects at scale.

With help from a number of partners and industry leaders, in 2023 Gates Family Foundation also assembled a broad coalition of public and private institutions to form the Colorado Mass Timber Coalition (CMTC). CMTC’s mission is to accelerate the use of mass timber products and technology in the next generation of buildings in Colorado, and to create a future where mass timber products can be made here using timber harvested locally, including timber resulting from efforts to improve forest and watershed health. The Coalition is anchored at the National Forest Foundation.

Landscape-scale conservation persists as a priority for the Foundation. In 2023 we supported a major land conservation project in the San Luis Valley in collaboration with Western Rivers Conservancy and continued our support of Keep It Colorado’s programming and problem-solving projects. We have also sustained our commitment to focused landscapes in Southeast Colorado and the San Luis Valley. 2023 marked our ninth year of support to partner organizations Palmer Land Conservancy and the Rio Grande Headwaters Land Trust, two community-based organizations implementing and developing conservation tools and thoughtful approaches to ensure land protection and water management and provide long-term conservation solutions to these regions. A total of $1,335,000 of funding was distributed in 2023 to support work in Southeast Colorado and the San Luis Valley through the focus landscapes program.

We continue to be inspired by our partners and the work they’re doing to conserve our unique landscapes and waterways and support the communities that live and access these places. In 2024, Gates remains committed to tackling challenges and finding opportunities through collaboration, listening, and championing ideas both big and small.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| Bluff Lake Nature Center | $75,000 |

Parks & Recreation |

||

| Central Colorado Conservancy | $30,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| City of Craig | $20,000 |

Parks & Recreation |

||

| City of Las Animas | $25,000 |

Parks & Recreation |

||

| City of Wheat Ridge | $30,000 |

Parks & Recreation |

||

| Colorado Northwestern Community College | $15,000 |

Parks & Recreation |

||

| Conservation Colorado Education Fund | $80,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Conservation Lands Foundation | $25,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Custer 2020 | $20,000 |

Parks & Recreation |

||

| Eagle Valley Land Trust | $30,000 |

Natural Resources > Land Trust Capacity Building |

||

| Ecosystem Integrity Fund V | $2,000,000 |

Natural Resources |

||

| Field of Dreams 2 | $25,000 |

Parks & Recreation |

||

| GES Coalition | $25,000 |

Parks & Recreation |

||

| Grand Mesa Nordic Council | $20,000 |

Parks & Recreation |

||

| Huerfano County | $16,700 |

Parks & Recreation |

||

| Keep it Colorado | $20,000 |

Natural Resources > Land Trust Capacity Building |

||

| Lincoln Institute of Land Policy | $10,000 |

Natural Resources > Balanced Water Management |

||

| Lyme Timber Company LP — Forest Fund VI | $1,000,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Middle Park Medical Foundation | $20,000 |

Parks & Recreation |

||

| Montrose Regional Health | $20,000 |

Parks & Recreation |

||

| National Fish and Wildlife Foundation | $150,000 |

Natural Resources > Ecosystem Services |

||

| National Forest Foundation | $625,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| National Forest Foundation | $15,000 |

Natural Resources > Land Trust Capacity Building |

||

| National Forest Foundation | $250,000 |

Natural Resources > Balanced Water Management |

||

| New Venture Fund | $50,000 |

Natural Resources > Balanced Water Management |

||

| Sangre de Cristo Acequia Association | $20,000 |

Natural Resources > Balanced Water Management |

||

| The Alliance for Collective Action | $0 |

Natural Resources |

||

| Town of Buena Vista | $20,000 |

Parks & Recreation |

||

| Town of Eads | $40,000 |

Parks & Recreation |

||

| Town of Otis | $25,000 |

Parks & Recreation |

||

| Trinity Community Park | $20,000 |

Parks & Recreation |

||

| Urban Land Conservancy | $75,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Urban Land Institute Foundation | $50,000 |

Natural Resources > Balanced Water Management |

||

| Western Landowners Alliance | $30,000 |

Natural Resources > Balanced Water Management |

||

| Western Rivers Conservancy | $50,000 |

Natural Resources > Landscape Conservation |

||

| Yampa Valley Community Foundation | $3,000 |

Natural Resources |

Ana Soler, Senior Program Officer

Ana Soler, Senior Program OfficerGates Family Foundation is committed to advancing a Colorado where all children have access to educational opportunities that support their long-term success. We firmly believe that investing in solutions that support students who are most in need raises outcomes for all. The Foundation’s education strategies have historically been rooted in an effort to address inequities — and a commitment to diversity, equity, and inclusion (DEI) remains an important part of our current strategy. In 2023, we also continued to shape our work in education through a Foundation-wide commitment to be responsive to the impacts of climate change and the shifting conditions caused by the pandemic.

There is much work to be done to raise outcomes for all students in Colorado. In 2023, students in nearly every grade and subject had lower rates of grade-level proficiency than before the pandemic on the Colorado Measures of Academic Success (CMAS) standardized tests. Across the state, only 44 percent of students met or exceed expectations in English Language Arts, and only 33 percent did so in mathematics. Large proficiency gaps between student groups persist; a more than 30 percentage-point gap in proficiency exists between students who qualify for free- or reduced-price lunch and those who do not.

In 2023, Gates’ education program committed $3,865,600 to 31 organizations via 33 strategic grants and $1,200,000 in responsive capital grants to 25 organizations, guided by three strategies:

This strategy includes investing in new learning models, informal out-of-system learning environments (like microschools); and investing in innovative new models or leaders who want to pilot new ideas during summer and out-of-school time. Below are a few of the organizations that the education team had the honor of supporting:

Wildflower Montessori Public Schools of Colorado expanded its reach to Grand Junction by launching five Montessori micro schools in a predominantly low-income, Latino community.

La Luz is a community partner-intensive micro school for middle school students in metro Denver. At La Luz, the school year is broken down into multi-week learning units based at community organizations. La Luz partners with community organizations, like the Denver Zoo, to co-create authentic learning experiences where students can develop skills through targeted instruction and feedback, practice and reflection, and real-world application. La Luz tracks academic and competency growth. The micro school supported 22 students in the 2023-2024 school year and plans to support more than 40 families next school year.

This strategy includes supporting multi-district community and school district partnerships that are focused on climate change education and college and career pathways. The education staff had the honor of supporting:

A three-year grant totaling $1,750,000 from Gates to Lyra Colorado in 2023 will support five rural Colorado communities as they re-envision education and workforce opportunities for students and economies and also will support the ongoing development of three innovation zones in Denver Public Schools.

Ensuring a diverse teacher workforce in rural areas, retaining a diverse teacher workforce in urban areas, supporting advocacy that elevates student voice at the grassroots and grasstops levels, and launching and sustaining pooled funds and investments to support innovation and address new challenges in education are all strategies that strengthen conditions for sustained innovation. Below are a few of the organizations that the education staff had the honor of supporting in 2023:

Fort Lewis College (FLC) Foundation in Durango and the Southwest Indigenous Language Development Institute (SILDI). This three-year partnership between FLC’s School of Education and three Ute tribes (Southern Ute Indian Tribe, Ute Mountain Ute Tribe, and Northern Ute Tribe) is focused on regenerating the Ute Language, developing a Ute language curriculum, and certifying Ute language teachers. Before launching SILDI, only 32 fluent Ute speakers were living.

RootED plays a strong backbone role in supporting innovation in the Denver metro area. RootEd galvanizes its advocacy grantees in support of innovation zones and protects the autonomy of district schools. RootEd is a solid partner in the Organizing Educations in Colorado (OEC) Funder Collaborative which supports grassroots education advocacy. In 2023 RootED, Denver Families, City Fund, Lyra and others helped each new board member understand the importance of innovation schools and zones as an option within the Denver Public Schools portfolio.

Also in 2023, RootEd launched the Denver Education Explorer. The platform hosts two tools for exploring local school data:

— Denver School Insights is a free, public dashboard intended for use by elected officials, education organizations, and people who are interested in district academic outcomes at a citywide or regional level. The dashboard provides accessible, comprehensive, and transparent school information to highlight bright spots in academic growth; identify persistent challenges; understand where additional support for schools is needed, and hold district leaders accountable.

— The Mile High School Guide helps parents and caregivers choose a public school in Denver that best fits the needs of their child. The guide provides detailed information about each school, allowing users to view and compare academic information, student and teacher demographics, social-emotional supports, enrichment opportunities, and more

In addition to grantmaking, Foundation staff work to convening stakeholders and funding partners for collective action. Highlights from 2023 include:

Gates Family Foundation continuously examines how our organization fulfills its mission and how best to integrate DEI in all levels and aspects of our work. Gates’ education staff was part of the team that created an Equity in Action plan outlining steps to address DEI issues across the Foundation.

Education staff also joined a national DEI practitioners’ group that includes the Walton Family Foundation, the Bill and Melinda Gates Foundation, the Ford Foundation, and others to share best practices, resources, and strategies to cultivate equity and belonging.

As a result of these efforts, the Foundation board and staff welcomed new members with diverse perspectives and backgrounds, included DEI goals in new board member training, increased program officer accessibility, and began the process of revising our grant applications to include a DEI lens.

In April 2023, in partnership with Caring for Colorado and Caring for Denver, Gates Family Foundation launched the Youth and Policy Impact Group. The group is focused on supporting efforts to capture and elevate youth voices to inform policy at the school, district, city, and state levels so that the entire education system can be more responsive to the needs of young people. The group has drafted a mission, outlined several strategies, and plans to increase funder participation in 2024.

Gates also continues to be a member of the Organizing for Education in Colorado (OEC) Funder Collaborative (formerly “CEO”). Other members in 2023 included Wend Collective, RootEd, and Rose Community Foundation. Together, the group pooled and distributed a total of $235,000 to nine organizations focused on implementing a community plan to advocate for a policy or practice change.

In 2023, an external evaluation of OEC was conducted by RootEd Growth. The methodology included 12 interviews with funders, and grantees, past and current, and two focus groups with young people who have been involved with OEC-funded initiatives. A key finding indicates that OEC reached its primary goal of increasing the voice and power of those least represented or heard in the educational system through its grantmaking efforts and processes. The study found that OEC’s strategic efforts contributed to a paradigm shift in Colorado’s educational system where organizing is now perceived to improve school systems. OEC participants will host a reception in 2024 to share results.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| 50CAN Inc. | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Archuleta County Education Center | $35,000 |

Education |

||

| Arrupe Jesuit High School | $50,000 |

Education > Learning Environment Innovation |

||

| Atlas Preparatory School | $30,000 |

Education > Learning Environment Innovation |

||

| Axis International Academy | $25,000 |

Education |

||

| Battle Rock Charter School | $40,000 |

Education > Learning Environment Innovation |

||

| Be the Change Community School | $31,600 |

Education > Learning Environment Innovation |

||

| Boys & Girls Clubs of the San Luis Valley | $75,000 |

Education |

||

| Chaffee County Childcare Initiative | $15,000 |

Education |

||

| Chalkbeat | $100,000 |

Education > Conditions for Sustained Innovation > Informed Communities > Addressing Civic News Gaps |

||

| Chance Sports | $30,000 |

Education > Learning Environment Innovation |

||

| CLLARO | $40,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Charter Facility Solutions | $100,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Children’s Campaign | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado League of Charter Schools | $80,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado League of Charter Schools | $30,000 |

Education > Learning Environment Innovation |

||

| Colorado Succeeds | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Youth Congress | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Compass for Lifelong Discovery | $10,000 |

Education > Learning Environment Innovation |

||

| Ednium The Alumni Collective | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Empower Community High School | $36,000 |

Education > Learning Environment Innovation |

||

| English in Action | $30,000 |

Education |

||

| Fort Lewis College Foundation | $150,000 |

Education > Learning Environment Innovation |

||

| Highline Academy | $25,000 |

Education > Learning Environment Innovation |

||

| Kwiyagat Community Academy | $30,000 |

Education > Learning Environment Innovation |

||

| La Luz Education | $30,000 |

Education > Conditions for Sustained Innovation |

||

| Legacy Institute | $150,000 |

Education > Learning Environment Innovation |

||

| Lyra Colorado | $1,750,000 |

Education > School System Innovation |

||

| Metropolitan State University of Denver | $75,000 |

Education |

||

| Moonshot edVentures | $70,000 |

Education > Learning Environment Innovation |

||

| Muslim Youth for Positive Impact | $35,000 |

Education > Conditions for Sustained Innovation |

||

| National Wildlife Federation | $120,000 |

Education |

||

| New Legacy Charter High School | $100,000 |

Education > Learning Environment Innovation |

||

| Our Turn Inc. | $35,000 |

Education > Conditions for Sustained Innovation |

||

| Pagosa Peak Open School | $25,000 |

Education > Learning Environment Innovation |

||

| Re:Vision | $25,000 |

Education |

||

| Reschool | $60,000 |

Education > Learning Environment Innovation |

||

| RISE Colorado | $50,000 |

Education > Conditions for Sustained Innovation |

||

| RootED | $90,000 |

Education > School System Innovation |

||

| RootED | $400,000 |

Education > Conditions for Sustained Innovation |

||

| Sims-Fayola Foundation, Inc. | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Southwest Colorado Education Collaborative | $35,000 |

Education > Learning Environment Innovation |

||

| Special Education Leader Fellowship c/o Propeller | $45,000 |

Education > Conditions for Sustained Innovation |

||

| Squared Network (The) | $150,000 |

Education > Learning Environment Innovation |

||

| Tact Kids Inc. | $40,000 |

Education |

||

| Teach For America | $25,000 |

Education > Conditions for Sustained Innovation |

||

| The Wildflower Foundation | $25,000 |

Education |

||

| The Wildflower Foundation | $95,000 |

Education > Learning Environment Innovation |

||

| Think 360 Arts For Learning Inc. | $40,000 |

Education > Conditions for Sustained Innovation |

||

| Town of Buena Vista | $45,000 |

Education |

||

| University of Colorado at Denver | $30,000 |

Education > Conditions for Sustained Innovation |

||

| Vision Charter Academy | $20,000 |

Education > Learning Environment Innovation |

||

| Walking Mountains Science Center | $15,000 |

Education |

||

| Wild Plum Center for Young Children and Families | $20,000 |

Education |

||

| Yampa Valley Community Foundation | $3,000 |

Education > School System Innovation |

||

| Youthroots | $25,000 |

Education > Conditions for Sustained Innovation |

Laia Mitchell, Senior Program Officer, Community Development

Laia Mitchell, Senior Program Officer, Community DevelopmentIn 2023, increased inflation put pressure on low- and moderate-income households in Colorado and across the country. A corresponding rise in interest rates has been challenging for community development partners. The cost of capital has been detrimental to low-to-moderate income households looking for homeownership, for small business owners looking for growth capital, and for developers building affordable housing and community facilities. The 2023 legislative session sparked a statewide conversation about land use decisions. While the 2023 bill did not pass, the debates on land use, zoning, and the state’s appropriate role in determining community growth patterns and density continued into the 2024 session, where lawmakers passed six major bills to address housing affordability.

Implementation of Proposition 123, passed by Colorado voters in 2022 to establish a statewide affordable housing fund to increase housing supply, began in 2023. By the end of 2023, many Colorado communities had opted in to participate in the housing program. Grants for land banking, modular construction, and housing construction loans (debt program) have all launched through the Colorado Housing and Finance Authority and the Colorado Division of Housing, bringing the promise of expanded housing opportunities across the state.

Also in 2023, an unprecedented number of newly arrived residents, primarily from Venezuela, have come to Colorado, fleeing persecution and economic turmoil in search of new opportunity. Denver and other local communities have the opportunity to be the most welcoming version of themselves, seeking creative solutions to meet basic needs, create work access pipelines, and address short-and long-term housing.

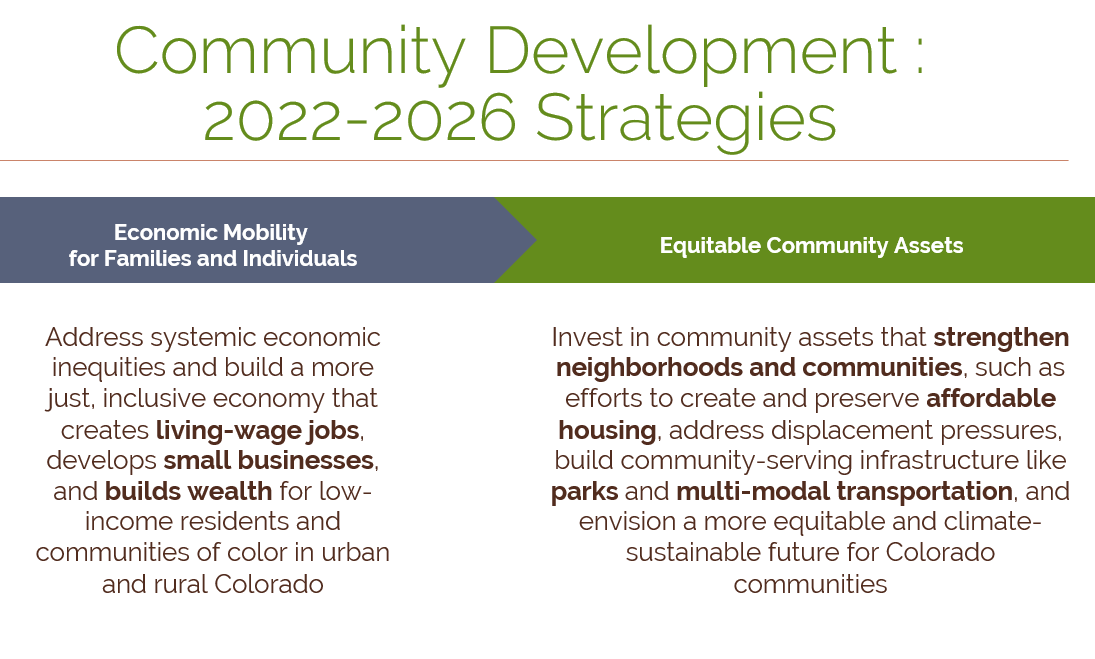

At the Foundation, Community Development staff continue to invest in solutions that advance economic mobility and create access to equitable community assets in Colorado. Addressing structural inequities and advancing climate solutions are two Foundation-wide priorities as well, touching all of our strategic focus areas.

— $1,873,000 in strategic grants to 31 organizations and $1,647,750 in responsive capital grants to 19 organizations

— A total of $1.75 million to three new community development-focused Program-Related Investments (PRIs): First Southwest Bank ($1 million), Elevation Community Land Trust’s Developer Startup Investment fund ($550,000), Sober Apartment Living Colorado ($200,000). There were also new Mission Related Investments to Rose Affordable Housing Preservation VI, Lafayette Square Business Development Company, and the Mission Colorado Fund.

The Foundation continued to elevate its focus on affordable and accessible housing in Colorado. The Foundation has supported the Community Land Trust model as an important way to increase opportunities for homeownership in Colorado. In 2024, GFF made a large five-year capacity grant to Elevation Community Land Trust (ECLT) in conjunction with the Capital Grants program and a program related investment commitment to ECLT for predevelopment financing. Gates supported and attended the inaugural Colorado Community Land Trust convening, hosted by the Chaffee Housing Trust, and made a capital grant commitment to the GES Coalition for land acquisition.

Additional housing grant investments included support for policy work and capacity building by Enterprise Community Partners, a ‘get homeownership ready’ course by Boss Generation, expanding access to accessory dwelling units through the West Denver Renaissance Collaborative, and Justice for the People Legal Center to build capacity for mobile home ownership in the Westwood neighborhood of Denver. A grant to Colorado Latino Leadership, Advocacy & Research Organization (CLLARO), shared with the GFF Education program, will support research on Latino/Latina housing needs, education access, and more across the state.

This year, the Gates Community Development program supported economic mobility with expanded investment in workforce development (both policy and data sharing through the Colorado Equitable Economic Mobility Initiative, and practice through support of Activate Work’s workforce expansion in the tech sector). GFF supported building a more inclusive economy through community wealth building strategies (Center for Community Wealth Building), and entrepreneurship with a three-year grant to Startup Colorado, to support rural regions of the state.

Gates also helped commission a report on the state of Colorado Commercial Real Estate Ownership, to increase access to ownership for nonprofits, small businesses, and BIPOC- and women-owned businesses in Colorado.

The Foundation advanced equity and climate-focused work with a grant to Denver Urban Gardens to increase green spaces in west Denver, and to the Climate Strong Initiative-a cohort of climate-focused Entrepreneurs of Color. A three-year grant to Denver Streets Partnership will build greener and more affordable transportation options beyond private vehicles.

As we look to 2024 and beyond, the Foundation continues to listen, learn, and look for ways to advance economic mobility, promote community wealth building strategies, increase housing access and affordability, and support the development of community-serving assets. Please reach out with your ideas and insights! You can submit ideas here, or contact me directly here.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| A Woman’s Place | $35,000 |

Well-Being of Children, Youth & Families |

||

| A.R. Mitchell Museum | $500 |

Arts & Culture |

||

| Acequia Institute | $30,000 |

Community Development > Food Systems & Agriculture |

||

| Achieve Inc. | $20,000 |

Well-Being of Children, Youth & Families |

||

| Activate Work Inc. | $50,000 |

Community Development > Economic Mobility |

||

| Apprentice of Peace Youth Organization | $20,000 |

Well-Being of Children, Youth & Families |

||

| Association of Fundraising Professionals Colorado Chapter | $20,000 |

Community Development |

||

| Axis Health System | $30,000 |

Well-Being of Children, Youth & Families |

||

| Be the Gift Inc. | $15,000 |

Well-Being of Children, Youth & Families |

||

| BEN Colorado | $50,000 |

Community Development > Economic Mobility |

||

| BeyondHome | $20,000 |

Well-Being of Children, Youth & Families |

||

| Bicycle Colorado | $225,000 |

Community Development > Equitable Community Assets |

||

| Boss Generation | $15,000 |

Community Development > Economic Mobility |

||

| Boulder Public Library | $20,000 |

Arts & Culture |

||

| Boys & Girls Clubs of Chaffee County | $50,000 |

Well-Being of Children, Youth & Families |

||

| Boys & Girls Clubs of Metro Denver | $120,000 |

Well-Being of Children, Youth & Families |

||

| Bridge (The) | $25,000 |

Well-Being of Children, Youth & Families |

||

| Center for African American Health | $25,000 |

Well-Being of Children, Youth & Families |

||

| Center for Community Wealth Building | $120,000 |

Community Development > Economic Mobility |

||

| Center for Community Wealth Building | $25,000 |

Community Development > Equitable Community Assets |

||

| Chaffee Housing Authority | $50,000 |

Well-Being of Children, Youth & Families |

||

| Chaffee Housing Trust | $10,000 |

Community Development > Equitable Community Assets |

||

| Chicano Humanities and Art Council | $10,000 |

Arts & Culture |

||

| City of Fort Collins | $25,000 |

Arts & Culture |

||

| City of Manitou Springs | $25,000 |

Arts & Culture |

||

| City of Trinidad | $2,000 |

Community Development |

||

| CLLARO | $20,000 |

Community Development > Economic Mobility |

||

| CO-Invest – Mission Colorado Fund | $1,000,000 |

Community Development > Economic Mobility |

||

| Co-Lead International | $50,000 |

Community Development > Economic Mobility |

||

| Colorado Community College System Foundation | $20,000 |

Community Development > Economic Mobility |

||

| Colorado Criminal Justice Reform Coalition | $30,000 |

Well-Being of Children, Youth & Families |

||

| Colorado Enterprise Fund | $20,000 |

Community Development > Economic Mobility |

||

| Colorado Equitable Economic Mobility Initiative | $50,000 |

Community Development > Economic Mobility |

||

| Colorado Inclusive Economy | $30,000 |

Community Development > Economic Mobility |

||

| Colorado League of Charter Schools | $20,000 |

Community Development > Equitable Community Assets |

||

| Colorado Mountain College Foundation | $30,000 |

Well-Being of Children, Youth & Families |

||

| Commún | $35,000 |

Community Development > Equitable Community Assets |

||

| Community Health Partnership | $30,000 |

Well-Being of Children, Youth & Families |

||

| CrossPurpose | $25,000 |

Well-Being of Children, Youth & Families |

||

| Denver Area Youth for Christ | $25,000 |

Well-Being of Children, Youth & Families |

||

| Denver Arts and Venues | $200,000 |

Arts & Culture |

||

| Denver Civic Ventures | $20,000 |

Community Development > Equitable Community Assets |

||

| Denver Housing Authority | $50,000 |

Community Development > Equitable Community Assets |

||

| Denver Urban Gardens | $35,000 |

Community Development > Equitable Community Assets |

||

| Denver Urban Gardens | $25,000 |

Community Development > Food Systems & Agriculture |

||

| El Centro Su Teatro | $20,000 |

Arts & Culture |

||

| Elevation Athletic Performance Foundation | $20,000 |

Community Development |

||

| Elevation Athletic Performance Foundation | $5,000 |

Community Development > Equitable Community Assets |

||

| Elevation Community Land Trust | $1,000,000 |

Community Development > Equitable Community Assets |

||

| Elevation Community Land Trust | $500,000 |

Community Development > Equitable Community Assets |

||

| Elevation Community Land Trust – Developer Startup Investment | $550,000 |

Community Development |

||

| Enterprise Community Partners Inc. | $100,000 |

Community Development > Economic Mobility |

||

| Fax Partnership (The) | $70,000 |

Community Development > Equitable Community Assets |

||

| First Southwest Bank | $1,000,000 |

Community Development > Economic Mobility |

||

| Food Justice Northwest Aurora | $25,000 |

Community Development > Food Systems & Agriculture |

||

| Food to Power | $22,000 |

Community Development > Food Systems & Agriculture |

||

| FrontLine Farming | $60,000 |

Community Development > Food Systems & Agriculture |

||

| Grand Lake Area Historical Society | $30,000 |

Arts & Culture |

||

| Growing Gardens of Boulder County | $20,000 |

Community Development > Food Systems & Agriculture |

||

| Interfaith Hospitality Network of Colorado Springs | $10,000 |

Well-Being of Children, Youth & Families |

||

| Justice for the People Legal Center | $60,000 |

Community Development > Equitable Community Assets |

||

| Karval Community Alliance | $25,000 |

Well-Being of Children, Youth & Families |

||

| KidsPak | $20,000 |

Well-Being of Children, Youth & Families |

||

| La Puente Home | $50,000 |

Well-Being of Children, Youth & Families |

||

| Lafayette Square Business Development Company | $1,500,000 |

Community Development > Economic Mobility > Equitable Community Assets |

||

| Loaves and Fishes Ministries of Fremont County | $25,000 |

Well-Being of Children, Youth & Families |

||

| Longmont Museum | $40,000 |

Arts & Culture |

||

| Loveland Youth Gardeners | $10,000 |

Community Development > Food Systems & Agriculture |

||

| Lyons Emergency Assistance Fund – LEAF | $20,000 |

Well-Being of Children, Youth & Families |

||

| Magic Circle Players | $25,000 |

Arts & Culture |

||

| Miners Alley Playhouse | $30,000 |

Arts & Culture |

||

| Moffat Road Railroad Museum | $20,000 |

Arts & Culture |

||

| Momentum Advisory Collective | $50,000 |

Well-Being of Children, Youth & Families |

||

| Montbello Organizing Committee | $130,000 |

Community Development > Equitable Community Assets |

||

| Montbello Organizing Committee | $70,000 |

Community Development > Economic Mobility |

||

| Museum of Friends | $30,000 |

Arts & Culture |

||

| Museum of Friends | $500 |

Arts & Culture |

||

| National Wildlife Federation | $35,000 |

Community Development |

||

| NeighborWorks of Southern Colorado | $75,000 |

Community Development > Equitable Community Assets |

||

| North London Mill Preservation, Inc. | $20,000 |

Arts & Culture |

||

| Nourish CO | $45,000 |

Community Development > Economic Mobility |

||

| Paradox Community Trust | $30,000 |

Community Development > Equitable Community Assets |

||

| Pikes Peak United Way | $25,000 |

Well-Being of Children, Youth & Families |

||

| Pine River Shares | $53,750 |

Community Development > Food Systems & Agriculture |

||

| Project Worthmore | $40,000 |

Well-Being of Children, Youth & Families |

||

| Redline Contemporary Art Center | $15,000 |

Community Development > Equitable Community Assets |

||

| Response: Help for Survivors of Domestic and Sexual Assault | $20,000 |

Well-Being of Children, Youth & Families |

||

| Riverside Educational Center | $40,000 |

Well-Being of Children, Youth & Families |

||

| Rose Affordable Housing Preservation Fund VI | $3,000,000 |

Community Development > Equitable Community Assets |

||

| Sedgwick County | $75,000 |

Well-Being of Children, Youth & Families |

||

| Sister Carmen Community Center | $20,000 |

Well-Being of Children, Youth & Families |

||

| Sober Apartment Living CO | $200,000 |

Community Development > Equitable Community Assets |

||

| Sober Apartment Living CO | $30,000 |

Well-Being of Children, Youth & Families |

||

| Southeast Colorado Creative Partnership | $50,000 |

Arts & Culture |

||

| Start Up Colorado | $110,000 |

Community Development > Economic Mobility |

||

| Steel City Theatre Company | $25,000 |

Arts & Culture |

||

| Struggle of Love Foundation | $25,000 |

Well-Being of Children, Youth & Families |

||

| The Alliance for Collective Action | $0 |

Community Development |

||

| Think 360 Arts For Learning Inc. | $10,000 |

Community Development > Equitable Community Assets |

||

| Thriving Families | $35,000 |

Well-Being of Children, Youth & Families |

||

| Tigray-Ethiopian Community Association of Colorado | $30,000 |

Well-Being of Children, Youth & Families |

||

| United Way of Larimer County | $20,000 |

Well-Being of Children, Youth & Families |

||

| Victor Lowell Thomas Museum | $40,000 |

Arts & Culture |

||

| Volunteers of America | $55,000 |

Well-Being of Children, Youth & Families |

||

| We Help and Love Everyone (WHALE) | $20,000 |

Well-Being of Children, Youth & Families |

||

| Western Colorado Community Foundation | $25,000 |

Community Development |

||

| Wray Public Library | $25,000 |

Arts & Culture |

||

| Yampa Valley Community Foundation | $3,000 |

Community Development |

Melissa Milios Davis, Vice President, Informed Communities

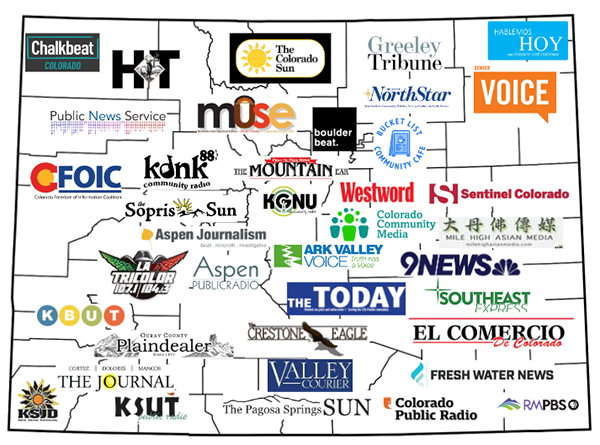

Melissa Milios Davis, Vice President, Informed CommunitiesAs Colorado emerges from the pandemic years, our communities are being challenged by divisive national rhetoric, digital disinformation campaigns, and social isolation. Within this context, Gates Family Foundation firmly believes that Colorado’s trusted sources of local news have a unique and important role to play in helping local communities reimagine and rebuild Colorado’s public square, both online and in person.

In 2023, our Informed Communities program continued to make grants, convene partners, and pool funds with local and national foundations to help ensure that all Coloradans have access to reliable local news and information they need to participate in a healthy democracy and make well-informed decisions about a wide range of issues that are important to the future of our state.

To support informed communities, Gates focuses attention and resources on three strategies:

In 2023, Gates’ Informed Communities program awarded a total of $403,000 to five grantees:

— $250,000 to the National Trust for Local News toward their purchase of a new community printing press to serve 23 Colorado Trust for Local News publications; in 2024 NTLN plans to offer mission-aligned printing services to dozens of other small publishers on the Front Range, who have faced double-digit cost increases in recent years;

— $62,000 to Hearken to support the 2023 Colorado Engaged Elections Fellowship, where 13 newsrooms had the opportunity to collaborate, learn from industry experts including including Hearken co-founder Jennifer Brandel, and share best practices for engaged journalism — raising the bar for election reporting and civic participation and setting the stage for 2024’s statewide Voter Voices initiative. Each Engaged Elections Fellowship newsroom also received a $1,000 stipend to support their engagement strategy;

— $35,000 to Colorado Public Radio to help support a major upgrade of the Denverite website and share learning with other newsrooms;

— $31,000 to Aurora Media Group to support the sustainability of Sentinel Colorado, which provides daily local news coverage for Aurora’s diverse, growing, and vibrant communities; and

— $25,000 to the Reporters Committee for Freedom of the Press to support a Colorado-based media law attorney who represents Colorado newsrooms and journalists on important matters related to freedom of information and public accountability.

In addition, in 2023 Gates’ Education program awarded a two-year, $100,000 grant to Chalkbeat Colorado, to support its efforts to engage more Spanish-speakers in public education conversations and coverage. Our Capital Grants program also awarded a $20,000 grant to the Denver Press Club, to support upgrades to its historic building.

— $302,640 total to 25 grantees through the second round of CMP’s Advancing Equity in Local News Fund, which aims to increase diversity and inclusion within Colorado newsrooms, strengthen connections between Colorado newsrooms and the communities they serve, and support newsroom leaders of color;

— $140,000 to 28 newsrooms in the 2023 #newsCOneeds initiative, providing them with $5,000 in matching funds plus technical support to plan and execute year-end giving campaigns to increase revenue from local individuals;

— A total of $300,000 to the Colorado News Collaborative and Colorado Press Association to support industry-led working groups, newsroom analysis and coaching, and pilot projects to address big issues facing the field — including digital conversion, the future of printing, and development of an ethnic media advertising network;

— The 2023 Colorado Media Project Summit, which brought together more than 130 leaders from Colorado journalism, nonprofits, government, philanthropy and business to develop a five-year vision for the future of local news in our state; and

— A new external evaluation of CMP’s grantmaking and impact.

As we look to the future, the Foundation is actively seeking ways to advance equity in local news, promote diverse ownership and voices in local news, increase collaboration and efficiencies in the local news ecosystem, and support the development of new revenue streams for local newsrooms. Please reach out to me with your ideas and insights!

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| Aurora Media Group | $31,000 |

Informed Communities > Inclusive Leadership, Voices & Models |

||

| Chalkbeat | $100,000 |

Education > Conditions for Sustained Innovation > Informed Communities > Addressing Civic News Gaps |

||

| Colorado Public Radio/KCFR | $35,000 |

Informed Communities > Addressing Civic News Gaps |

||

| Denver Press Club | $20,000 |

Informed Communities |

||

| Hearken Inc. | $62,000 |

Informed Communities > Inclusive Leadership, Voices & Models |

||

| National Trust for Local News | $250,000 |

Informed Communities > Civic News Ecosystem-Building |

||

| Reporters Committee for Freedom of the Press | $25,000 |

Informed Communities > Civic News Ecosystem-Building |

In 2022, the Natural Resources team enthusiastically implemented our first year of the Foundation’s 2022-2027 strategic plan. Lessons learned during its development have since serve to guide our team on the most impactful and intentional use of time and resources in the coming years — in both grantmaking and in strategic conversations and convenings. We know that tactical partnership is valued by our communities, so we are seeking ways to anticipate needs and be proactive in catalyzing these conversations and efforts.

New federal funding will provide a once-in-a-generation opportunity to move the needle for communities and partners working in many of the Foundation’s priority areas. The bipartisan Infrastructure Investment and Jobs Act includes billions of dollars for western water infrastructure projects and for climate resilience strategies such as restoring wetland and riparian areas. In addition, the Inflation Reduction Act promises even more for investing in domestic energy production while promoting clean energy.

All of these opportunities are closely aligned with goals of the Natural Resources program:

Colorado communities and economies require dependable and clean water supplies, healthy forests and watersheds, and lands that support agricultural production, wildlife habitat, and a way for people in every corner of the state to access the benefits of being outdoors. We have had the opportunity to sustain commitments on some of these fronts and to foster new growth in others.

In 2022, the Natural Resources program awarded:

$2,526,500 in strategic grants to 18 organizations

$130,0000 in responsive capital grants to three organizations

The Foundation also made a $200,000 MRI commitment to the Future of Water Fund

Balanced Water Management: The aridification of the West and water shortages across the region highlight the urgency of new and collaborative cross-sector solutions.

Staff participated in meetings hosted by the Water Foundation’s Water Table throughout the year. This learning opportunity provides insights both wide and deep into the serious challenges we face across the West in supporting natural habitats, agricultural resources and communities, recreational use, and municipalities and industry with the water quality and quantities required for each use. That learning supported or encouraged our commitments to funding nature-based solutions with Quantified Ventures as a solution in climate change adaptation and building resilience in landscapes and communities and partnering with the Colorado Water Trust to pioneer the tools and research needed to address river flows to benefit the environment and communities. Investments in the San Luis Valley continue to grow in light of water export threats, climate change, and groundwater depletion. The Theodore Roosevelt Conservation Partnership, American Rivers, the Salazar Center, and Colorado Open Lands are all working to advance solutions in this part of the state.

Forest Health and Watershed Restoration: Forest health and watershed health are closely linked, with a majority of Colorado’s water supply coming from forested watersheds.

In 2022 we continued our collaborative funding approach with the National Fish and Wildlife Foundation, Great Outdoors Colorado, and other state, federal, and private partners to support the RESTORE Colorado Program. This initiative advances land restoration efforts on river corridors, riparian areas and wetlands and forestland projects and prioritizes cross-jurisdictional projects at scale. Peaks to People is working to proactively treat fire risk in key watersheds in Northern Colorado, proving forest stewardship is an indispensable approach in achieving water security.

Landscape Conservation and Land Trust Capacity Building: We have sustained our commitment to our focused landscapes in Southeast Colorado and the San Luis Valley. Partner organizations Palmer Land Conservancy and the Rio Grande Headwaters Land Trust are collaborating with partners on innovative conservation tools and thoughtful approaches to ensure that the work done is resilient, community-based, and provides long-term solutions. A total of $1,185,000 of funding was distributed in 2022 in support of work in southeast Colorado and the San Luis Valley.

Multi-year commitments to land trust organizations Keep It Colorado and Montezuma Land Conservancy will sustain and grow the land trust community’s ability to advance policy in accordance with land conservation needs and opportunities while highlighting the history of land conservation and the challenges of creating a future that is equitable and invites all communities to engage with land and conservation in Colorado.

Our strategic plan calls for thoughtful advancement on climate and diversity, equity, and inclusion work across all our programs. These two pillars, which are inextricably intertwined, guide us both internally and externally to encourage critical thinking, to identify new voices and perspectives, and to be accessible to all communities working toward natural resources solutions in our state. We take seriously the opportunity to better elevate underrepresented voices and advance community-driven solutions to these challenges.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| American Rivers, Inc. | $50,000 |

Natural Resources > Balanced Water Management |

||

| Audubon Rockies | $125,000 |

Natural Resources > Balanced Water Management |

||

| Avesta Colorado Fund | $1,250,000 |

Natural Resources |

||

| Blackhorn Ventures Fund II | $2,000,000 |

Natural Resources |

||

| Colorado Headwaters Land Trust | $40,000 |

Natural Resources |

||

| Colorado Open Lands | $150,000 |

Natural Resources > Land Trust Capacity Building |

||

| Colorado State University | $50,000 |

Natural Resources > Balanced Water Management |

||

| Colorado Water Trust | $75,000 |

Natural Resources > Balanced Water Management |

||

| Colorado West Land Trust | $150,000 |

Natural Resources > Balanced Water Management |

||

| Concrete Couch | $15,000 |

Parks & Recreation |

||

| Conservation Finance Network | $25,000 |

Natural Resources > Land Trust Capacity Building |

||

| Delta County | $50,000 |

Parks & Recreation |

||

| Denver Botanic Gardens | $35,000 |

Parks & Recreation |

||

| Denver Civic Ventures | $50,000 |

Parks & Recreation |

||

| Eagle County | $25,000 |

Parks & Recreation |

||

| Future of Water Fund I | $200,000 |

Natural Resources |

||

| Keep it Colorado | $375,000 |

Natural Resources > Land Trust Capacity Building |

||

| Montezuma Land Conservancy | $300,000 |

Natural Resources > Land Trust Capacity Building |

||

| Montezuma Land Conservancy | $50,000 |

Natural Resources |

||

| Montrose Recreation District | $20,000 |

Parks & Recreation |

||

| National Fish and Wildlife Foundation | $225,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| National Wild Turkey Federation | $200,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Pacific Institute for Studies in Development, Environment and Security | $25,000 |

Natural Resources > Balanced Water Management |

||

| Park People | $40,000 |

Parks & Recreation |

||

| Peaks to People Water Fund | $225,000 |

Natural Resources > Balanced Water Management |

||

| Quantified Ventures | $100,000 |

Natural Resources > Forest Health & Watershed Restoration |

||

| Quantified Ventures | $101,500 |

Natural Resources > Balanced Water Management |

||

| Salida Area Parks, Open Space and Trails (SPOT) | $50,000 |

Parks & Recreation |

||

| Sonoran Institute | $100,000 |

Natural Resources > Balanced Water Management |

||

| Strasburg Metro Parks and Recreation District | $25,000 |

Parks & Recreation |

||

| Theodore Roosevelt Conservation Partnership | $50,000 |

Natural Resources > Balanced Water Management |

||

| Town of Haxtun | $50,000 |

Parks & Recreation |

||

| Town of Silver Plume | $43,000 |

Natural Resources |

||

| Trust For Public Land | $150,000 |

Parks & Recreation |

||

| Water Foundation | $150,000 |

Natural Resources > Balanced Water Management |

||

| Western Resource Advocates | $50,000 |

Natural Resources > Balanced Water Management |

The K-12 education program continues to be driven by the vision that all children in Colorado have access to educational opportunities that support their long-term success. The Foundation’s education strategies have historically been rooted in an effort to address inequities. The 2022 strategies retained that focus and added 1) being responsive to the shifting conditions caused by the pandemic and 2) the impact of climate change.

In 2022, the education team at Gates focused on the launch of the strategic plan that refined some strategies and expanded others. Based on learning from the last five years of grantmaking and community conversations, the Foundation believes supporting innovation within learning environments, supporting the conditions that support innovation, and supporting school system change is the best lever to meaningfully impact educational inequity in Colorado.

In 2022, Gates’ education program paid out $2,739,000 in strategic grants and $485,000 in responsive capital grants.

The Foundation supports the staff to function in roles beyond grantmaking and this includes convening stakeholders and funding partners for collective action. In 2022, the education team was involved in the following activities:

In response to the need for more equity in the philanthropic field for funding that meets community needs and amplifies youth voices in philanthropy, Ana provided ongoing strategic support to YouthRoots for the GIV Fellowship, a philanthropic and nonprofit fellowship program.

The education team facilitated a process to open lines of communication and cooperation and that resulted in more equitable access to education for families in the Roaring Fork area. To share lessons learned, in 2022 the Foundation released a case study, We are One Community, and 50 people attended a webinar to discuss the process and the outcomes with local leaders.

In the realm of climate change, Gates’ close partner and grantee Lyra Colorado continued to help partners in rural communities across the state to develop and expand initiatives that address climate change. Climatarium helps school districts, higher education institutions, and nonprofit partners identify existing and new resources for developing local and regional academic, career, and student leadership pathways for students.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| Bluff Lake Nature Center | $25,000 |

Education > Learning Environment Innovation |

||

| Colorado Charter Facility Solutions | $100,000 |

Education > Learning Environment Innovation |

||

| Colorado Children’s Campaign | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Education Organizing Funder Collaborative (CEO) | $150,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado League of Charter Schools | $40,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado League of Charter Schools | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Rocky Mountain School | $50,000 |

Education > Learning Environment Innovation |

||

| Colorado Succeeds | $60,000 |

Education > Conditions for Sustained Innovation |

||

| Colorado Youth Congress | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Community West Healthcare | $40,000 |

Education |

||

| Education Reform Now | $75,000 |

Education > Conditions for Sustained Innovation |

||

| Embark Education | $70,000 |

Education > School System Innovation |

||

| Embark Education | $70,000 |

Education > School System Innovation |

||

| Empower Schools, Inc. | $175,000 |

Education > Conditions for Sustained Innovation |

||

| Flame Lily Montessori | $25,000 |

Education |

||

| Great Education Colorado | $25,000 |

Education > Conditions for Sustained Innovation |

||

| Historic Hayden Granary Inc. | $70,000 |

Education > School System Innovation |

||

| Innovation in Learning Fund | $80,000 |

Education > Learning Environment Innovation |

||

| Keystone Center | $100,000 |

Education > Conditions for Sustained Innovation |

||

| Kwiyagat Community Academy | $150,000 |

Education |

||

| Lyra Colorado | $620,000 |

Education > School System Innovation |

||

| Maslow Academy of Applied Learning, Inc. | $20,000 |

Education |

||

| Mesa County Public Health | $70,000 |

Education |

||

| Mile High United Way | $20,000 |

Education |

||

| Montrose County School District RE-1J | $35,000 |

Education > Learning Environment Innovation |

||

| Montrose County School District RE-1J | $70,000 |

Education > School System Innovation |

||

| Montrose County School District RE-1J | $40,000 |

Education |

||

| Moonshot edVentures | $60,000 |

Education > Learning Environment Innovation |

||

| Public Education & Business Coalition – Teacher Residency Program | $250,000 |

Education |

||

| Reach Capital IV | $2,000,000 |

Education |

||

| Reach Opportunity II | $1,000,000 |

Education |

||

| Reschool | $30,000 |

Education > Learning Environment Innovation |

||

| RISE Colorado | $80,000 |

Education > Learning Environment Innovation |

||

| RootED | $100,000 |

Education > Conditions for Sustained Innovation |

||

| RootED | $300,000 |

Education > Conditions for Sustained Innovation |

||

| Sims-Fayola Foundation, Inc. | $50,000 |

Education > Conditions for Sustained Innovation |

||

| Southwest Open School | $50,000 |

Education |

||

| Stead School (The) | $20,000 |

Education |

||

| Thorne Nature Experience | $50,000 |

Education |

||

| University Preparatory School | $35,000 |

Education |

||

| University Preparatory School | $50,000 |

Education > Learning Environment Innovation |

||

| Yampa Valley Community Foundation | $500 |

Education |

Gates Family Foundation has a long history of viewing local news and information as vital civic infrastructure, connected to all of our issue areas. Since 1967, we’ve provided program and project support for public media. Since 2010 we’ve supported new nonprofit news startups, new beats, watchdog journalism and documentary projects. And in 2019, we made a catalytic, three-year commitment to launch the Colorado Media Project as a special initiative — thanks to funding carved out from Gates’ education, natural resources, community development and capital grantmaking programs.

But not until 2022 did Gates create a designated pot of funds to support a fourth strategic focus area: Informed Communities. Extensive landscape research, surveys, and partner conversations have guided our new five-year strategic plan, including the Foundation’s newest grantmaking program. Through this work, we aim to help ensure that all Coloradans can access, trust, and engage with reliable local news and information they need to participate in a healthy democracy and make well-informed decisions about issues important to the future of our state.

To support informed communities, we focus our attention and resources on three strategies:

In 2022, Gates’ Informed Communities program committed a total of $1,342,956 to nine grantees, including:

— The second round of CMP’s Advancing Equity in Local News grant program, which provided 27 new grants totaling $352,640 to support efforts to increase diversity, equity and inclusion (DEI) in Colorado newsrooms; build trust between Colorado newsrooms and the diverse communities they serve; and/or support more diverse and inclusive civic news leadership, entrepreneurship, ownership and narratives,

— The fifth year of CMP’s #newsCOneeds initiative that provided 32 Colorado newsrooms with $5,000 in matching funds plus technical support to plan and execute their year-end giving campaigns — which collectively raised more than $832,700 in total from local individuals,

— Seeding and launch of CMP’s Community News and Innovation Fund, which supports ecosystem builders including the Colorado Press Association, the Colorado News Collaborative, and the Public News Company as they help local newsrooms explore and pilot innovative solutions to business, digital and revenue challenges that they are facing right now, in communities across the state, and

— External evaluation of CMP’s grantmaking and impact.

A two-year, $112,000 commitment to the National Trust for Local News, to add operational capacity to the Colorado News Conservancy and Colorado Community Media, in support of a $750,000 impact investment from Gates awarded in 2021

A $50,000 grant to The Colorado Sun, to help drive reader revenue through marketing and membership, in support of an eight-year, $1.5 million impact investment from Gates awarded in 2020

Five other grants to advance various initiatives including a pilot project with the League of Women Voters in Larimer County, a summer photojournalism camp for rural teens on the Western Slope, and a two-year commitment to the Denver Democracy Summit.

As we look to the future, the Foundation is actively seeking ways to advance equity in local news, promote diverse ownership and voices in local news, increase collaboration and efficiencies in the local news ecosystem, and support the development of new revenue streams for local newsrooms. Please reach out to me with your ideas and insights!

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| Colorado Media Project | $110,956 |

Informed Communities > Civic News Ecosystem-Building |

||

| Colorado Media Project | $900,000 |

Informed Communities > Civic News Ecosystem-Building |

||

| Colorado State University | $5,000 |

Informed Communities > Addressing Civic News Gaps |

||

| KGNU Community Radio | $60,000 |

Informed Communities |

||

| League of Women Voters of Larimer County | $50,000 |

Informed Communities > Inclusive Leadership, Voices & Models |

||

| National Trust for Local News | $112,000 |

Informed Communities > Civic News Ecosystem-Building |

||

| Reporters Committee for Freedom of the Press | $25,000 |

Informed Communities > Civic News Ecosystem-Building |

||

| Rocky Mountain Public Media | $15,000 |

Informed Communities > Civic News Ecosystem-Building |

||

| The Colorado Sun | $50,000 |

Informed Communities > Addressing Civic News Gaps |

||

| University of Denver | $70,000 |

Informed Communities > Inclusive Leadership, Voices & Models |

||

| Western Slope Photojournalism | $5,000 |

Informed Communities > Inclusive Leadership, Voices & Models |

For Colorado communities, 2022 was a time of both economic uncertainty and unprecedented federal investment, creating big challenges and opportunities for Colorado communities. Rising inflation and supply chain pains were felt in our homes and in staff rooms. Rising interest rates have added complexity for our nonprofit and community partners looking to find a permanent location or build affordable housing and community assets. At the same time, a huge influx of federal funds is bringing incredible opportunities for state and local governments. The passage of Proposition 123 in 2022 established a statewide affordable housing fund, which promises to increase access to housing supply at a time when our state desperately needs new affordable homes.

At the Foundation, Community Development staff worked to apply the new strategic plan, investing in solutions that advance Economic Mobility and create access to Equitable Community Assets in Colorado. Across the Foundation, staff worked to address structural inequity and invest in climate solutions.

In 2022, the Gates Community Development program committed $1,980,000 in strategic grants to 24 organizations and $743,000 in responsive capital grants to 15 organizations. There were two new community development related Program Related Investments in 2022 totaling $1.55 million: Colorado Housing Accelerator Initiative Fund ($1 million), and Elevation Community Land Trust for the Chestnut Lofts project ($550,000). There were also two Mission Related Investment commitments: to the Greater Colorado Venture Fund II and the Avesta Colorado Fund.

With a new strategic focus on affordable and accessible housing in Colorado, the Foundation made five grants and one PRI and dedicated additional staff time to participating in the sector. Housing grantees in 2022 included 9to5 Colorado to support housing justice efforts for mobile home communities, planning efforts to increase workforce housing in La Junta Colorado, pre-development support for an emerging community land trust — Home Trust of Ouray County — and support for developments led by Urban Land Conservancy and the ArtSpace Space to Create initiative.

This year, the Gates Community Development program supported economic mobility with expanded investment in workforce development, with grant investments in policy through the Colorado Equitable Economic Mobility Initiative, and investment in practice through ActivateWork. Gates made two notable investments in community wealth building strategies by supporting the Center for Community Wealth Building for collaborative work on access and ownership of commercial property and the Rocky Mountain Employee Ownership Center for its work in rural communities. The Foundation also continued its support of entrepreneurship strategies with 2022 grants to the Latino Leadership Institute’s Latino Entrepreneur Access Program, AYA Foundation and the Black Business Initiative, and First Southwest Community Fund for its work supporting rural entrepreneurs in the San Luis Valley and beyond.

Staff at Gates have observed the need for earlier support to nonprofits and community-serving development efforts as a strategy to increase equitable community assets. In today’s fast-paced and challenging real estate and construction markets, support for planning and design of community-serving assets can make a significant difference in what projects actually get built. In conjunction with the Capital grants program, Gates provided pre-development support to community-driven and BIPOC-led development efforts in 2022, including a GES Coalition-driven site in Globeville, Commún in Loretto Heights, Elevate Athletics in northeast Denver, and Cultivando in Adams County. As we move forward in 2023, we continue to ask the question: Who owns the city? How do we shift ownership of real estate to community-led and community-service projects?

The Foundation also advanced climate-focused work in Community Development with a three-year commitment to support advocacy and policy efforts to shift the transportation sector in Colorado; a Black-led greening initiative in the historic Five Points neighborhood, and two rural agricultural grants.

As we look to 2023 and beyond, the Foundation continues to listen, learn, and look for ways to advance economic mobility, promote community wealth building strategies, increase housing access and affordability, and support the development of community-serving assets. Please reach out with your ideas and insights! You can submit ideas here, or contact me directly here.

| Grantee | Amount Awarded | Type | Strategy | Area Served |

|---|---|---|---|---|

| 9to5 National Association of Working Women/Colorado Chapter | $100,000 |

Community Development > Equitable Community Assets |

||

| Activate Work Inc. | $100,000 |

Community Development > Economic Mobility |

||

| Adaman Club | $15,000 |

Arts & Culture |

||

| Art Students League of Denver | $15,000 |

Arts & Culture |

||

| Artspace Projects, Inc. | $150,000 |

Community Development > Equitable Community Assets |

||

| Artspace Projects, Inc. | $50,000 |

Community Development |

||

| AYA Foundation | $90,000 |

Community Development > Economic Mobility |

||

| Bicycle Colorado | $225,000 |

Community Development > Equitable Community Assets |

||

| Boys & Girls Clubs of Larimer County | $25,000 |

Well-Being of Children, Youth & Families |

||

| Boys and Girls Clubs of Weld County | $40,000 |

Well-Being of Children, Youth & Families |

||

| BuCu West | $50,000 |

Community Development > Economic Mobility |

||

| Butterfly Pavilion | $150,000 |

Arts & Culture |

||

| CASA of Larimer County Inc. | $20,000 |

Well-Being of Children, Youth & Families |

||

| Catholic Charities of Central Colorado | $50,000 |

Well-Being of Children, Youth & Families |

||

| Center for African American Health | $30,000 |

Well-Being of Children, Youth & Families |

||

| Center for Community Wealth Building | $160,000 |

Community Development > Equitable Community Assets |

||

| Center for the Arts Evergreen, Inc. | $25,000 |

Arts & Culture |

||

| Central City Opera House Association | $20,000 |

Arts & Culture |

||

| City of La Junta | $35,000 |

Community Development > Equitable Community Assets |

||

| Civic Center Conservancy | $80,000 |

Arts & Culture |

||

| Cleo Parker Robinson Dance | $50,000 |

Arts & Culture |

||

| Clifton Christian Church Food Bank | $25,000 |

Well-Being of Children, Youth & Families |

||

| Collide Capital | $1,000,000 |

Community Development |

||

| Colorado Black Arts Movement | $50,000 |

Arts & Culture |

||

| Colorado Equitable Economic Mobility Initiative | $100,000 |

Community Development > Economic Mobility |

||

| Colorado Housing Accelerator Initiative (CHAI) Fund | $1,000,000 |

Community Development |

||

| Colorado Housing and Finance Authority | $25,000 |

Community Development > Economic Mobility |

||

| Colorado Photographic Arts Center | $25,000 |

Arts & Culture |

||

| Colorado Springs Pioneers Museum | $20,000 |

Arts & Culture |

||

| Commún | $50,000 |

Community Development > Equitable Community Assets |

||

| Community of Caring Foundation | $40,000 |

Well-Being of Children, Youth & Families |

||

| Community Partnership Family Resource Center | $30,000 |

Well-Being of Children, Youth & Families |

||

| Community Resource Center | $60,000 |

Capital Project Support > Civic Projects & Leadership |

||

| Connect Church | $20,000 |

Well-Being of Children, Youth & Families |

||

| CrossPurpose | $25,000 |

Well-Being of Children, Youth & Families |

||

| Crow Luther Cultural Events Center/Town of Eads | $50,000 |

Arts & Culture |

||

| Cultivando | $25,000 |

Community Development > Equitable Community Assets |

||

| Cultivando | $50,000 |

Well-Being of Children, Youth & Families |

||

| Dancing Spirit Inc. | $50,000 |

Arts & Culture |

||

| Denver Foundation | $60,000 |

Capital Project Support > Civic Projects & Leadership |

||

| Developmental FX | $20,000 |

Well-Being of Children, Youth & Families |

||

| Elevation Athletic Performance Foundation | $25,000 |

Community Development > Equitable Community Assets |

||

| Elevation Athletic Performance Foundation | $25,000 |

Community Development |

||

| Elevation Community Land Trust – Chestnut Lofts | $550,000 |

Community Development |

||

| Fax Partnership (The) | $150,000 |

Community Development > Equitable Community Assets |

||

| First Southwest Community Fund | $100,000 |

Community Development > Economic Mobility |

||

| Florence Architectural and Cultural Traditions F.A.C.T. | $35,000 |

Arts & Culture |

||

| Fox West Theatre Alliance | $50,000 |

Arts & Culture |

||

| Friends of the Genoa Tower | $50,000 |

Arts & Culture |

||

| Garage Workspace | $20,000 |

Capital Project Support > Civic Projects & Leadership |

||

| GES Coalition | $100,000 |

Community Development > Equitable Community Assets |

||

| Grassroots Foundation, Inc. | $50,000 |

Community Development > Economic Mobility |

||

| Greater Colorado Venture Fund II | $1,000,000 |

Community Development |

||

| Haven House of Montrose Inc. | $35,000 |

Well-Being of Children, Youth & Families |

||

| Hayden Heritage Center | $500 |

Arts & Culture |

||

| Historic Elitch Gardens Theatre Foundation | $20,000 |

Arts & Culture |

||

| Historic Routt County | $1,000 |

Arts & Culture |

||

| Home Trust of Ouray County | $50,000 |

Community Development > Equitable Community Assets |

||

| Judi’s House | $25,000 |

Well-Being of Children, Youth & Families |

||

| Karis Inc. | $20,000 |

Well-Being of Children, Youth & Families |

||

| Kim Robards Dance, Inc. | $15,000 |

Arts & Culture |

||

| Latino Cultural Arts Center | $40,000 |

Arts & Culture |

||

| Latino Leadership Institute | $50,000 |

Community Development > Economic Mobility |

||

| Lincoln Hills Cares | $15,000 |

Community Development |

||

| Mancos Common Press | $35,000 |

Community Development > Economic Mobility |

||

| Mesa County Libraries Foundation | $45,000 |

Arts & Culture |

||

| Mile High Connects | $25,000 |

Community Development > Equitable Community Assets |

||

| Miners Alley Playhouse | $25,000 |

Arts & Culture |

||

| Montezuma Orchard Restoration Project | $75,000 |

Community Development |

||

| Mountain Roots Food Project | $25,000 |

Community Development |

||

| Museum of Contemporary Art | $20,000 |

Arts & Culture |

||

| National Museum of World War II Aviation, Inc. | $25,000 |

Arts & Culture |

||

| National Wildlife Federation | $70,000 |

Community Development > Equitable Community Assets |

||

| Needful Provision, Inc. (NPI) | $10,000 |