Mary Seawell, Senior Vice President

Abby Schaller, Senior Program Officer

Ana Soler, Senior Program Officer

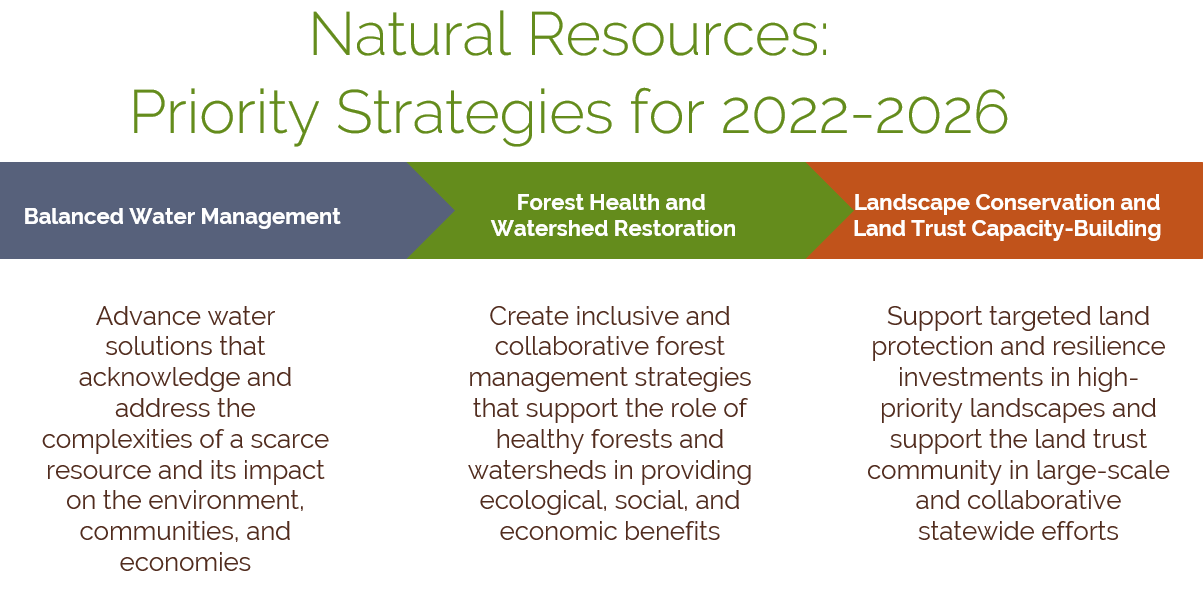

The mission of Gates Family Foundation’s K-12 education program is to ensure that all children in Colorado have access to education opportunities that support their long-term success. To advance this mission, we focus our resources to seed innovation and support effective and diverse autonomous public school models; pursue system-level reforms that create the conditions necessary to sustain effective schools; support community-based programs in rural areas; develop more robust human capital pipelines across the state; and sustain media, advocacy, research, and engagement efforts that strengthen the education ecosystem.

In 2020, Gates’ education program awarded $1,185,000 in strategic grants to 15 organizations and $525,000 in responsive capital grants to 12 organizations. This past year was characterized by unprecedented disruptions to student learning. The education program adapted grantmaking and approaches to respond quickly and flexibly to the changing realities of K-12 education in Colorado.

COVID Response

In the weeks after the March COVID-19 shutdowns, Gates staff gathered information from district partners on food distribution activities and needs. The Foundation rapidly deployed $22,500 in food security grants to key district partners.

Gates, Lyra Colorado, and a coalition of partners (RESCHOOL Colorado, Empower Schools, Donnell-Kay Foundation, Colorado Succeeds, RootED Denver, and Daniels Fund) launched the Education Innovation Fund – a K-12 initiative to support nimble and creative responses to meet students needs in the wake of COVID-19. The fund awarded 34 promising projects $320,000 in grants. Gates and partners captured lessons learned from the effort through video, virtual convenings, and surveys.

Gates worked with the Governor’s Office and Gary Community Ventures to launch the Response, Innovation, and Student Equity (RISE) Planning and Design Support (PDS) fund. This initiative supported 15 prospective applicants to the Governor’s RISE fund with resources and design support to develop impactful applications and strong implementation plans. The RISE PDS Fund prioritized support to rural applicants serving diverse student populations. Eight of the 15 PDS-funded projects were ultimately selected to receive significant grants from the RISE fund.

Gates staff also provided support to the Governor’s Office and the RISE Selection Committee with analysis, tools, and facilitation throughout the RISE review process. In total, the RISE fund awarded $41 million to 22 innovative efforts across the state.

Southwest Environment and Climate Institute

Lyra Colorado and Gates continue to partner on education projects statewide. Gates is a supporter of Lyra both through financial and staff time support. Gates and Lyra partnered with six southwest Colorado school districts and Fort Lewis College to launch the Colorado Environment and Climate Institute (ECI), a program that supports students with unique and shared climate change-focused curriculum, project-based learning, and career exploration. In August of 2020, students from all participating districts convened in Durango for a three-day kick-off Summer Institute. Gatherings were held outdoors, and the event strictly adhered to all public health guidelines. Students, teachers, and administrators who participated in the Institute left feeling energized about ECI and the year ahead.

Efforts to elevate student voice

There were several Gates-led efforts to include students in decision making.

Gates staff co-hosted a webinar with Chalkbeat Colorado and the Colorado Education Initiative to elevate student voices during the pandemic. Ten students from across the state shared their experiences of COVID-19 related impacts on school and home life, opinions and recommendations on remote learning, and their engagement with current events, including the racial justice movement. More than 170 parents, teachers, and community leaders logged in to hear from the panel.

In partnership with YouthRoots, Gates created a remote Philanthropy Fellowship for youth 18-24 who are interested in learning more about the work of foundations and nonprofits. Eleven foundations signed up to host two fellows each for the fall of 2021. The Growing Insight and Voice (GIV) Fellowship will provide opportunities for youth to discover and explore potential careers in the philanthropic and nonprofit fields; improve the ability of the philanthropic sector to meet community needs by including youth voice, expertise, and wisdom in foundation strategies; and develop a pipeline for youth from communities underrepresented in philanthropy to enter the field.

Gates worked in partnership with Lyra to recruit, train, and support youth advisors to inform all stages of planning, curriculum, and development for the Colorado Environmental Science and Climate Institute and to support grant review for the Governor’s RISE Fund.

Investments

Since 2018, Gates staff have investigated a number of edtech funds. Investments in 2020 include Reach Capital and Owl Ventures.

Reach Capital invests in people and solutions that broaden access to quality education. Edtech products in Reach’s portfolio are grounded in strong pedagogy, research-driven, and support students with limited educational opportunities due to their socioeconomic status, race and ethnicity, and geography.

Owl Ventures is at the forefront of the education technology wave and is recognized as the leader in the sector. As barriers that once impeded technological innovation in K-12 classrooms are rapidly removed, the opportunity grows to support transformative edtech companies that reshape learning and increase access for all students.

Collaboratives

In addition to grantmaking, the Gates education team also worked closely with strategic partners on some existing and some exciting new initiatives in 2020:

Colorado Education Organizing Funder Collaborative (CEO) – Gates staff has participated in this collaborative for six years, committing funding and staff time to support CEO’s mission to reduce the achievement and opportunity gaps for low-income public school students of color in the Denver metro area. CEO harnesses support for community organizing that educates, builds leadership among, and engages low-income parents and young people to advocate for effective education reform solutions. Over the years, CEO has increased collaborative efforts among grantees, has developed and implemented grantee self-assessment surveys of organizational strength and core organizing competencies, has provided responsive technical assistance to grantees based on survey results and shared learning, and has enhanced grantee operational and organizing capacity. Over the past six years Gates’ commitment of $375,000 to support the collaborative effort was joined by $1,744,000 in commitments from other foundations.

In 2020, Gates and Lyra Colorado staff initiated a meeting with multiple partners, including school districts in Fremont County (Cañon City Schools RE-1, Fremont School District RE-2, and Cotopaxi School District RE-3) and Pueblo Community College. These participants went on to form a multi-district collaborative, The Fremont Multidistrict Initiative, to reinvent how a region can cooperatively utilize resources and sustainably provide an outstanding educational experience for rural students by expanding opportunities and offering access to robust college and career pathways, regardless of the district they attend. To accomplish this work, the initiative established a steering committee composed of the superintendents from each district, as well as the dean of the Fremont campus of Pueblo Community College. Two of Gates’ grantees, Empower Schools and Trendlines, supported the initiative.

Through all of this work, the education team at Gates strives to be thoughtful partners and to listen to all participants in the education community, in order to make progress in advancing educational equity and access to opportunity for all students in Colorado. We are grateful to all of the organizations and communities with whom we have been honored to partner with over the course of this most extraordinary year.

2020 GRANTS AND IMPACT INVESTMENTS AWARDED: EDUCATIONAL EQUITY

| Grantee |

Amount Awarded |

Type |

Strategy |

Area Served |

|

5280 High School

|

$40,000 |

Capital Grant |

Education >

Autonomous Public Schools |

Denver >

Denver |

|

A+ Colorado

|

$60,000 |

Strategic Grant |

Education >

Advocacy |

* Statewide |

|

Academy of Advanced Learning

|

$30,000 |

Capital Grant |

Education >

Autonomous Public Schools |

El Paso >

Colorado Springs |

|

BookTrails Inc.

|

$10,000 |

Capital Grant |

Capital Project Support >

Education |

Routt >

Steamboat Springs |

|

Chalkbeat

|

$75,000 |

Strategic Grant |

Education >

Advocacy >

Informed Communities >

Addressing Civic News Gaps |

* Statewide |

|

Clayton Early Learning

|

$125,000 |

Capital Grant |

Capital Project Support >

Education |

Denver >

Denver |

|

Colorado Charter Facility Solutions

|

$100,000 |

Strategic Grant |

Education >

Autonomous Public Schools |

* Statewide |

|

Colorado Education Organizing Funder Collaborative (CEO)

|

$60,000 |

Strategic Grant |

Education >

Advocacy |

Denver >

Denver |

|

Colorado League of Charter Schools

|

$30,000 |

Strategic Grant |

Education >

Autonomous Public Schools |

* Statewide |

|

Colorado Succeeds

|

$60,000 |

Strategic Grant |

Education >

Innovation & Incubation |

* Statewide |

|

Colorado Youth Congress

|

$50,000 |

Strategic Grant |

Education >

Advocacy |

* Statewide |

|

Education Reform Now

|

$60,000 |

Strategic Grant |

Education >

Advocacy |

* Statewide |

|

Empower Community High School

|

$25,000 |

Capital Grant |

Education >

Autonomous Public Schools |

Arapahoe >

Aurora |

|

Firefly Autism

|

$40,000 |

Capital Grant |

Capital Project Support >

Education |

Jefferson >

Lakewood |

|

Hart Center for Public Service

|

$30,000 |

Capital Grant |

Capital Project Support >

Education |

Denver >

Denver |

|

HOPE Center

|

$10,000 |

Capital Grant |

Capital Project Support >

Education |

Denver >

Denver |

|

Keystone Policy Center

|

$25,000 |

Strategic Grant |

Education >

Human Capital |

* Statewide |

|

Lighthouse Writers Workshop Inc.

|

$60,000 |

Capital Grant |

Capital Project Support >

Education |

Denver >

Denver |

|

National Council on Teacher Quality

|

$25,000 |

Strategic Grant |

Education >

Human Capital |

* Statewide |

|

National Wildlife Federation

|

$120,000 |

Capital Grant |

Capital Project Support >

Education |

* Statewide |

|

Owl Ventures

|

$3,000,000 |

Mission-Related Investment |

Education |

|

|

Oxford Teachers Academy

|

$50,000 |

Strategic Grant |

Education >

Human Capital |

* Statewide |

|

Reach Capital III

|

$3,000,000 |

Mission-Related Investment |

Education |

|

|

RootED

|

$400,000 |

Strategic Grant |

Education >

Human Capital |

Denver >

Denver |

|

Seasons Schoolhouse Inc.

|

$15,000 |

Capital Grant |

Capital Project Support >

Education |

Gunnison >

Gunnison |

|

Valley Settlement

|

$40,000 |

Strategic Grant |

Education >

Rural Community-Based Programs |

Garfield >

Carbondale |

|

YMCA of Northern Colorado

|

$20,000 |

Capital Grant |

Capital Project Support >

Education |

Boulder >

Lafayette |

Finally, also in 2023 a total of $410,956 previously committed by Gates to the

Finally, also in 2023 a total of $410,956 previously committed by Gates to the  A total of $1,110,956 committed to the

A total of $1,110,956 committed to the

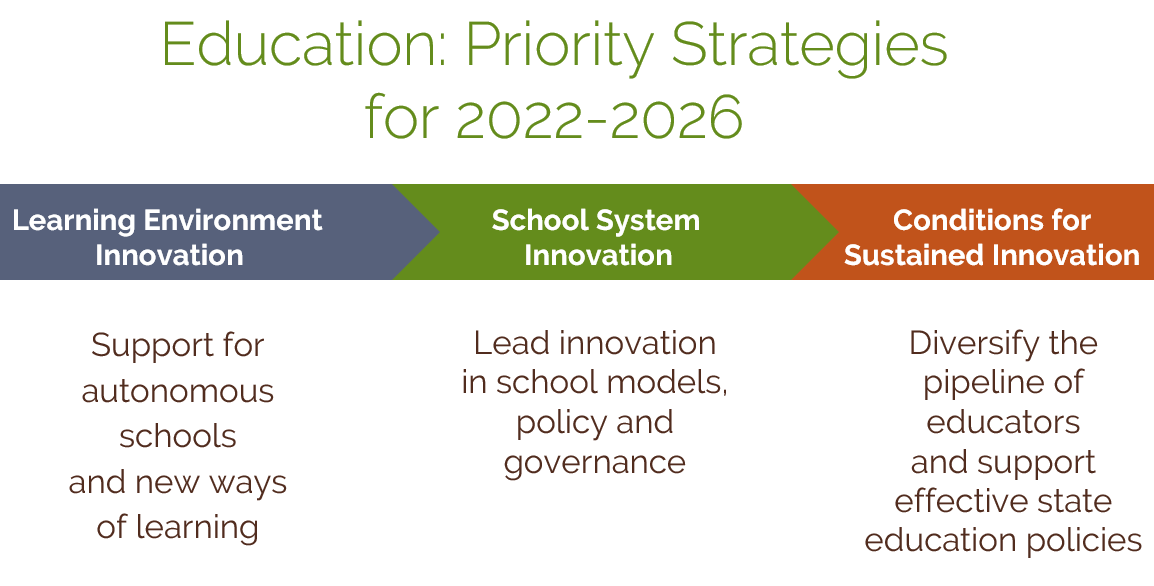

In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to

In 2019, the Community Development program committed $932,500 in strategic grants to 13 organizations and $465,000 in responsive capital grants to 12 organizations. New impact investments supporting vibrant communities in 2019 included a $500,000 MRI to  Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies:

Our Focus Landscapes initiative, a key element of our Natural Resources program, underwent a comprehensive review, revision, and re-launch in 2019. This initiative was launched in 2011 to help Colorado achieve landscape-scale conservation through the protection of private lands in specific geographies. A great deal of progress was made in North Park, southeast Colorado, and the San Luis Valley, resulting in more than 200,000 acres of farm and ranch lands conserved, along with their associated ecological values. The strategic review process was done in close partnership with the land trust organizations representing those geographies, providing lessons-learned and an exploration of emerging opportunities. The revised Focus Landscapes initiative will first focus on two geographies: